Description

Bitcoin Price Prediction using Machine Learning

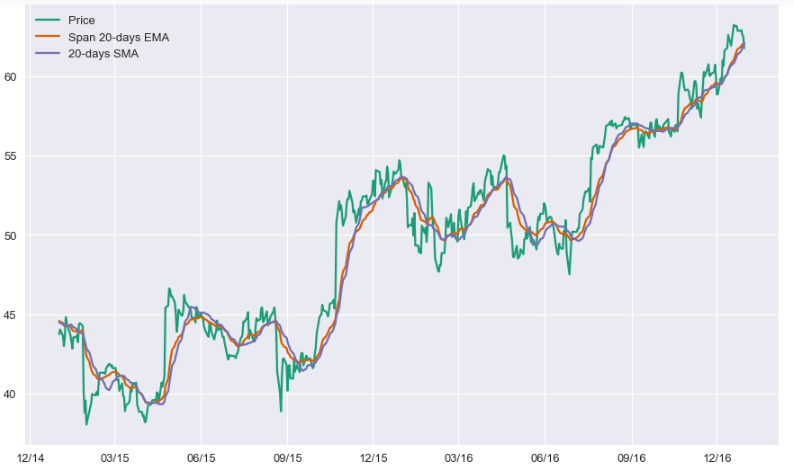

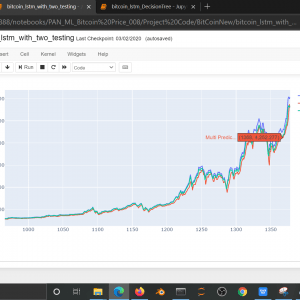

Machine learning and AI-assisted trading have attracted growing interest for the past few years. Here, we use this approach to test the hypothesis that the inefficiency of the cryptocurrency market can be exploited to generate abnormal profits. We analyze daily data for 1, 681 cryptocurrencies for the period between Nov. 2015 and Apr. 2018. We show that simple trading strategies assisted by state-of-the-art machine learning algorithms outperform standard benchmarks. Our results show that non-trivial, but ultimately simple, algorithmic mechanisms can help anticipate the short-term evolution of the cryptocurrency market. Bitcoin Price Prediction using Machine Learning

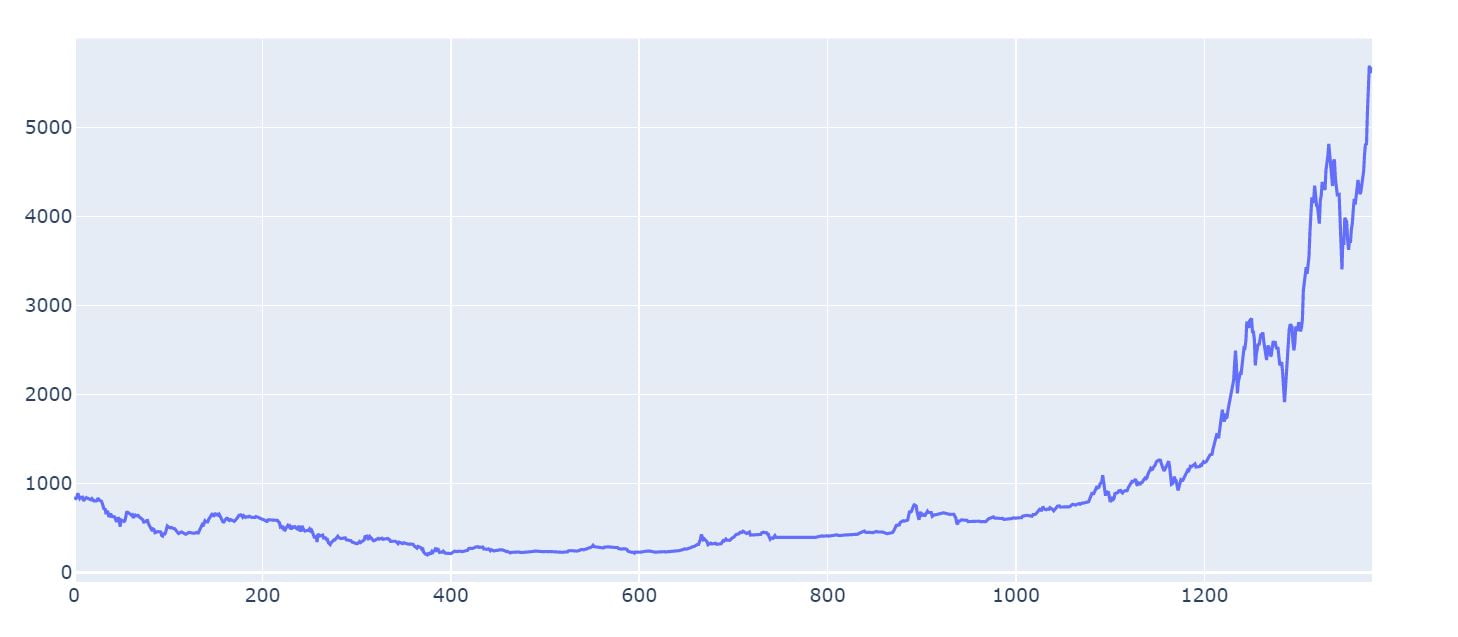

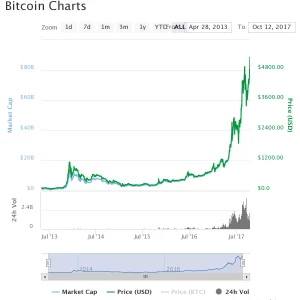

The popularity of cryptocurrencies has skyrocketed in 2017 due to several consecutive months of super-exponential growth of their market capitalization. Today, there are more than 1, 500 actively traded cryptocurrencies capitalizing over $300 billion, with a peak of the market capitalization totaling more than $800 billion in Jan. 2018. Between 2.9 and 5.8 million private as well as institutional investors are in the different transaction networks, according to a recent survey, and access to the market has become easier over time. Major cryptocurrencies can be bought using fiat currency in a number of online exchanges and then be used in their turn to buy less popular cryptocurrencies. The volume of daily exchanges is currently superior to $15 billion. Since 2017, over 170 hedge funds specialized in cryptocurrencies have emerged and bitcoin futures have been launched to address institutional demand for trading and hedging Bitcoin. Bitcoin Price Prediction using Machine Learning

Bitcoin Price Prediction using Machine Learning

Existing System:

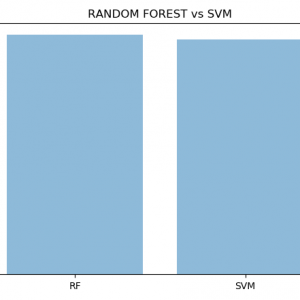

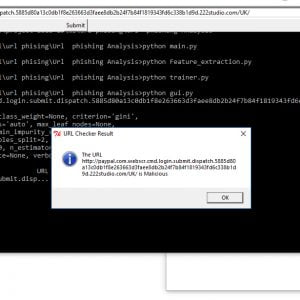

In the existing system, we analyzed stock markets prediction, which suggests that these methods could be effective also in predicting cryptocurrency prices. However, the application of machine learning algorithms to the cryptocurrency market has been limited so far to the analysis of Bitcoin prices, using random forests, Bayesian neural network, long short-term memory neural network? and other algorithms. These studies were able to anticipate, to different degrees, the price fluctuations of Bitcoin, and revealed that best results were achieved by neural network-based algorithms. Deep reinforcement learning was shown to beat the uniform buy and hold strategy in predicting the prices of 12 cryptocurrencies over one year period. Bitcoin Price Prediction using Machine Learning

Disadvantage:

- Other attempts to use machine learning to predict the prices of cryptocurrencies other than Bitcoin come from non-academic sources.

- Most of these analyses focused on a limited number of currencies and did not provide benchmark comparisons for their results.

Bitcoin Price Prediction using Machine Learning

Proposed System:

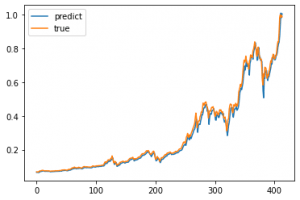

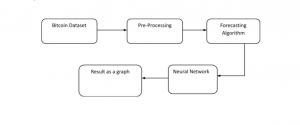

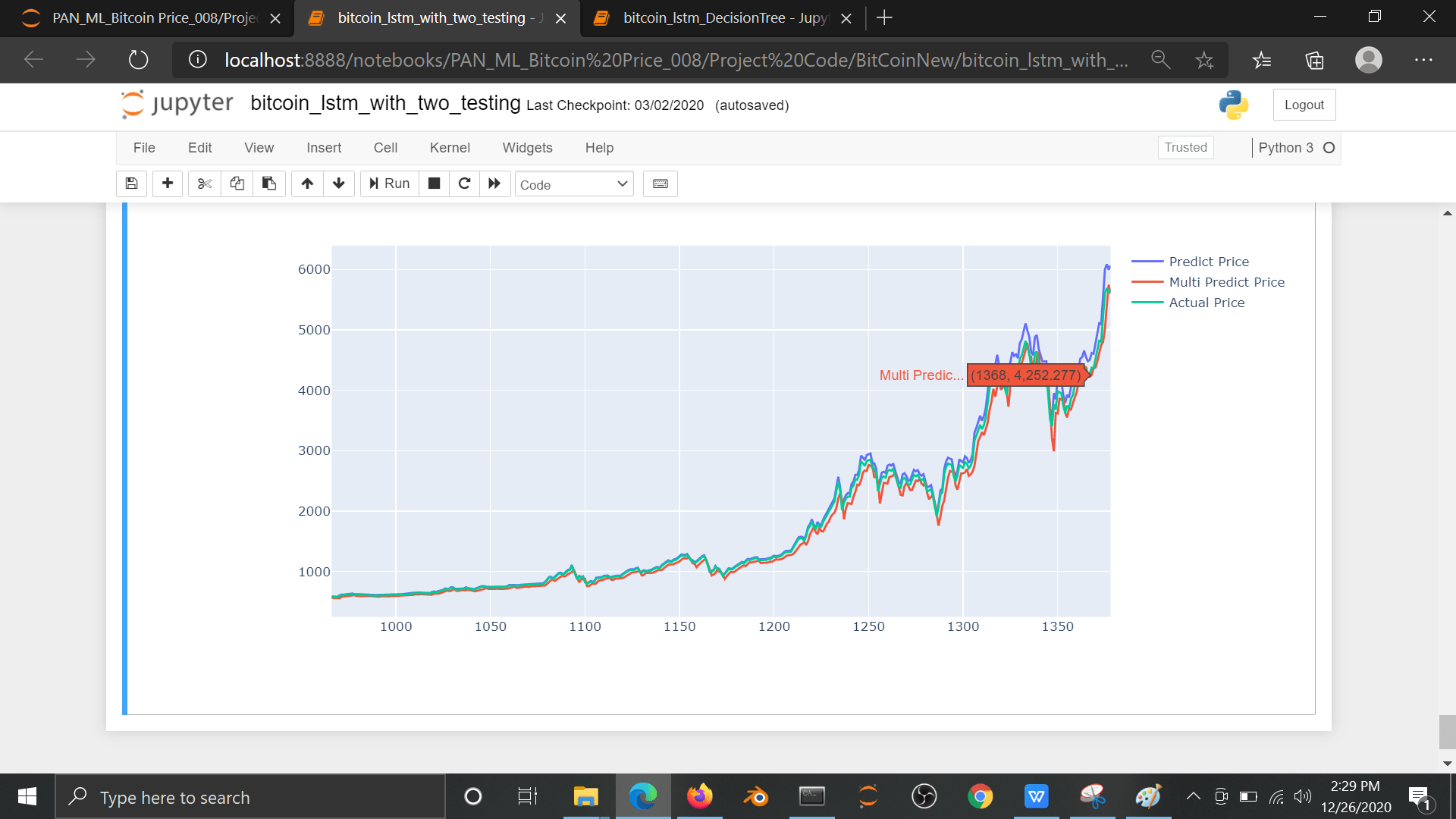

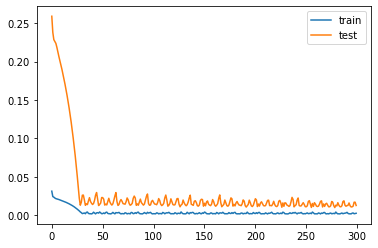

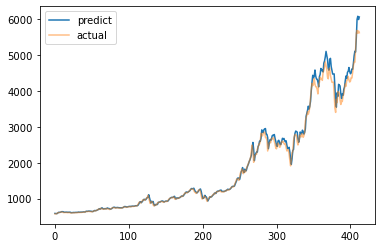

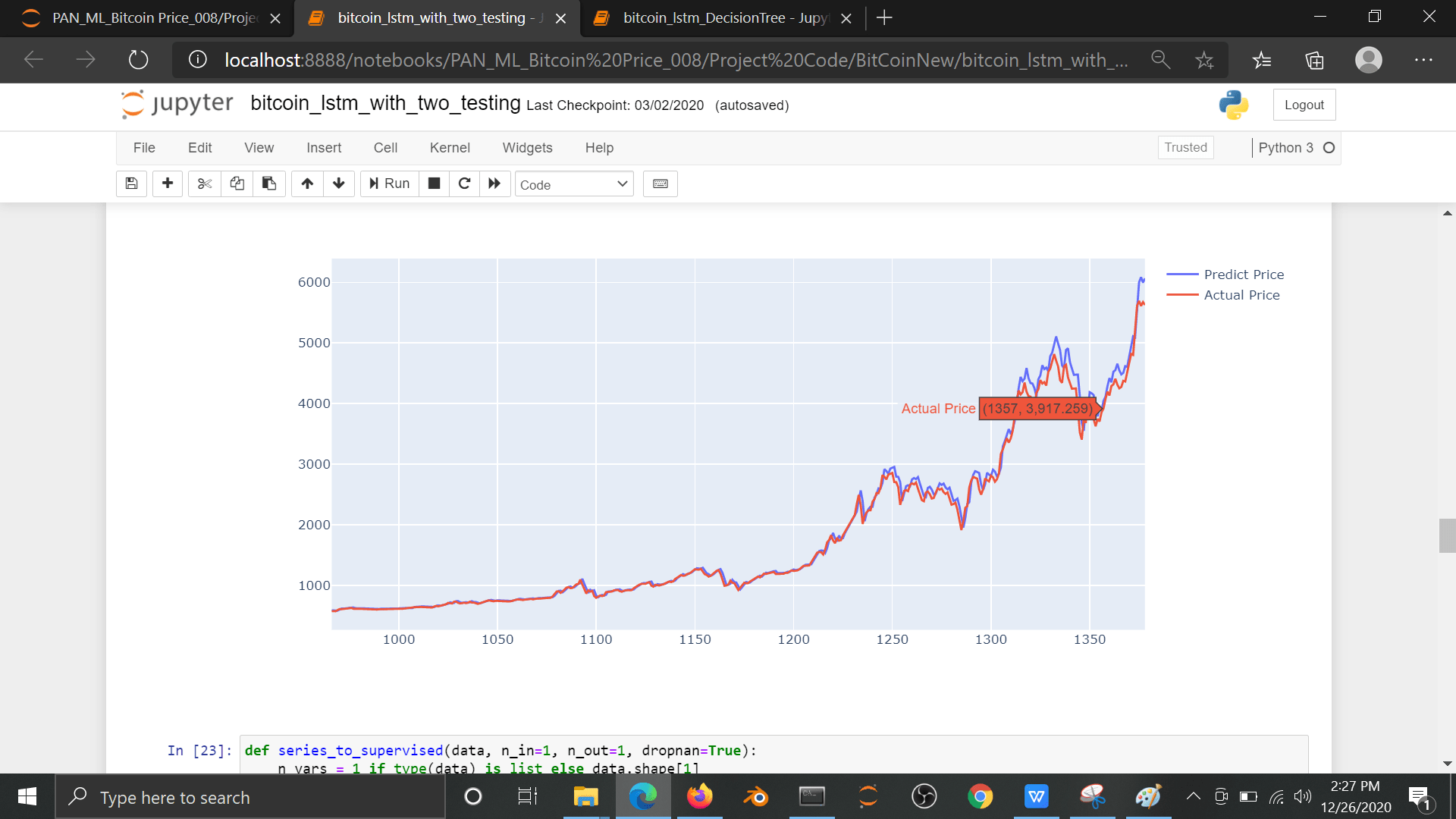

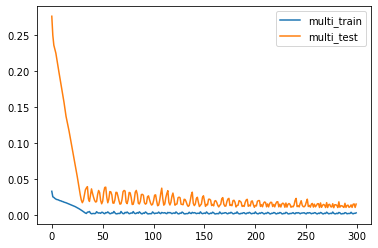

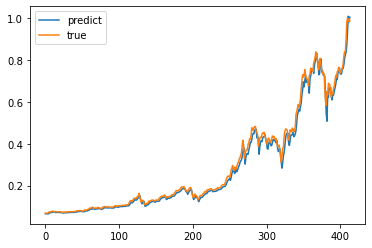

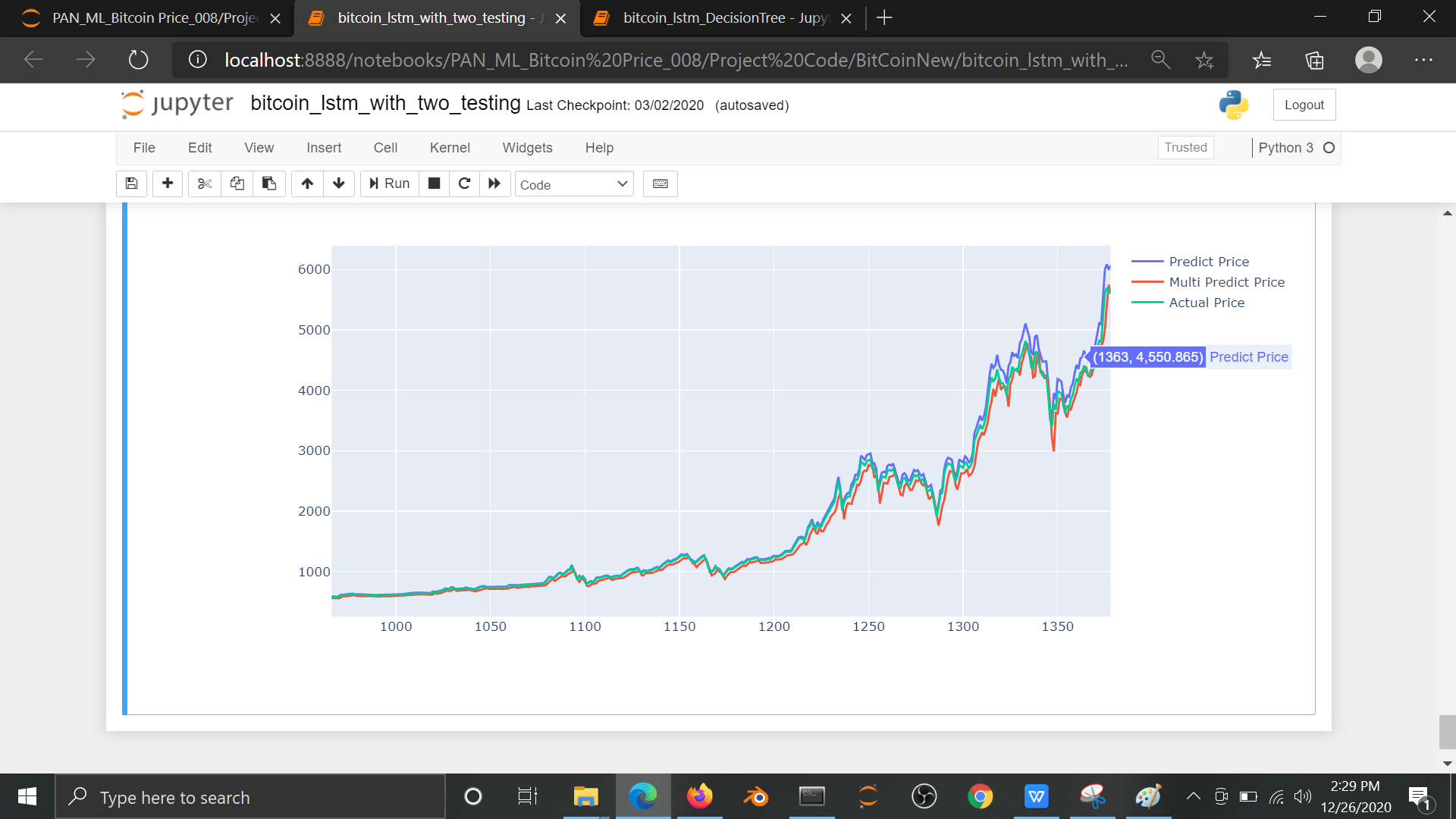

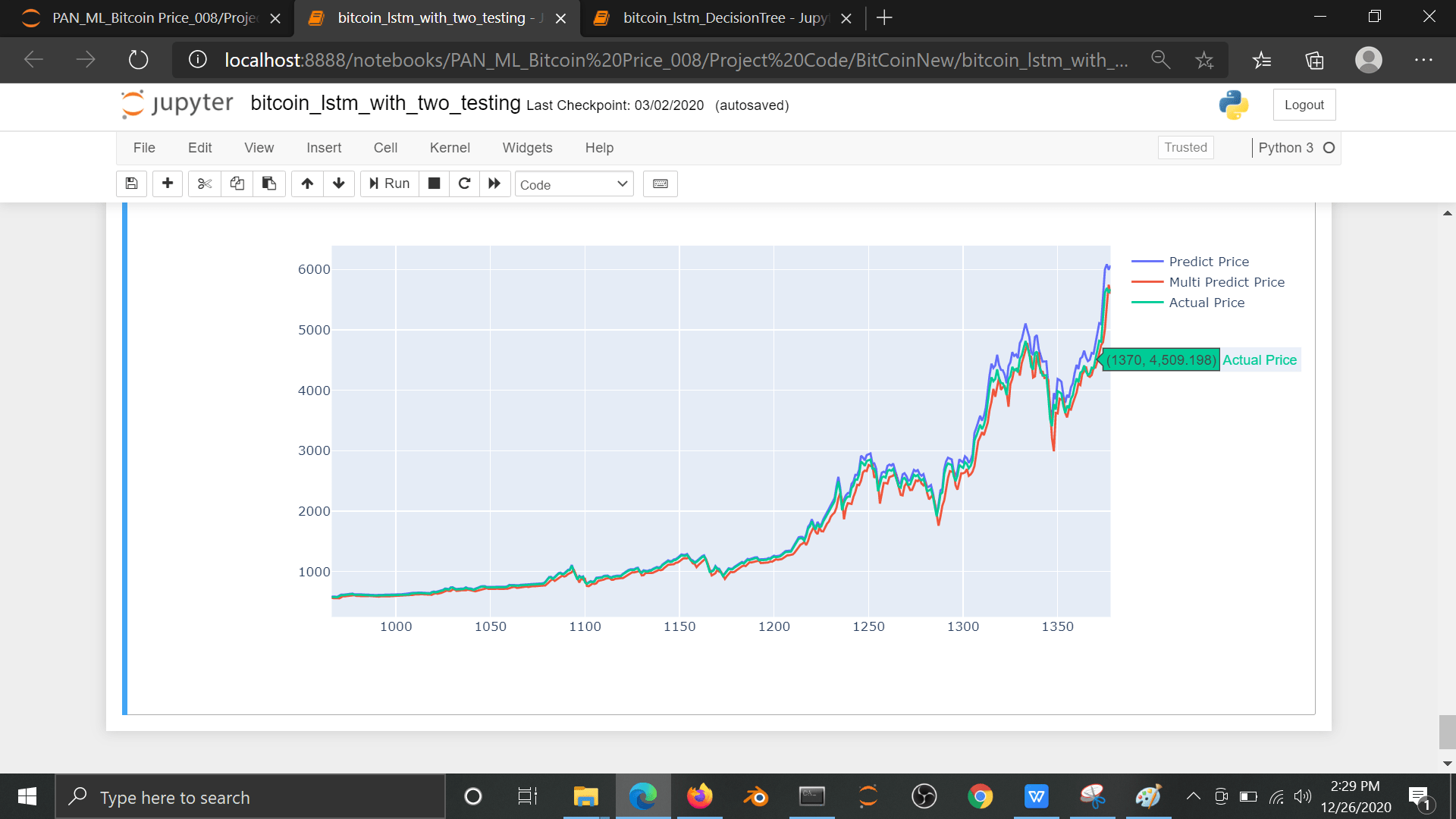

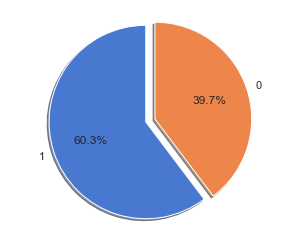

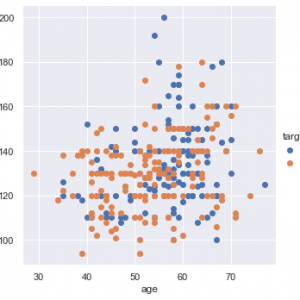

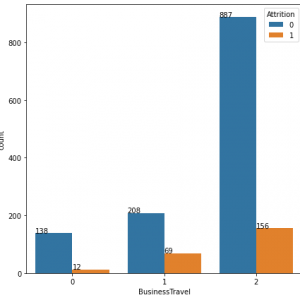

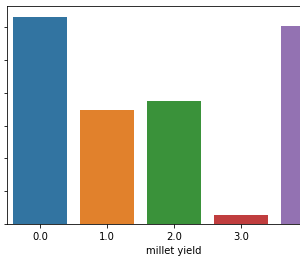

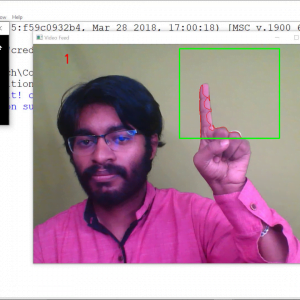

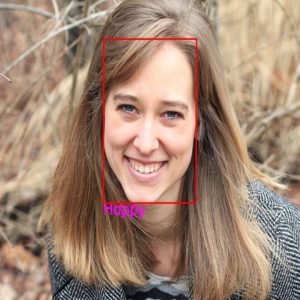

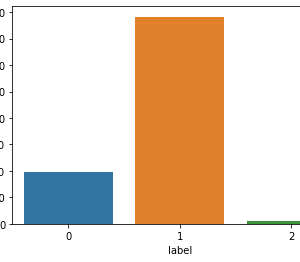

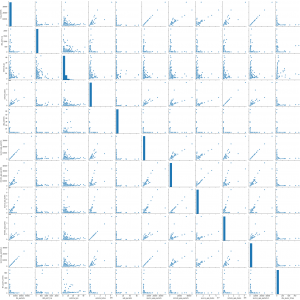

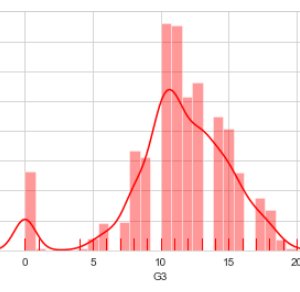

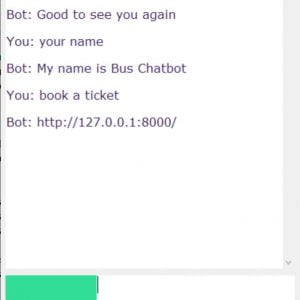

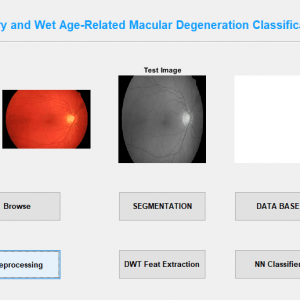

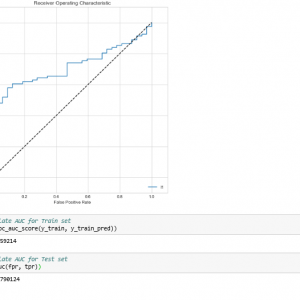

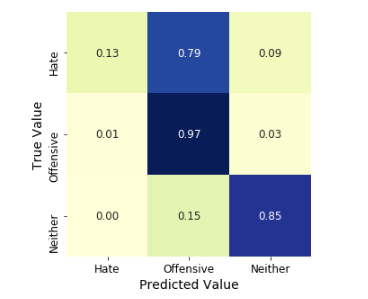

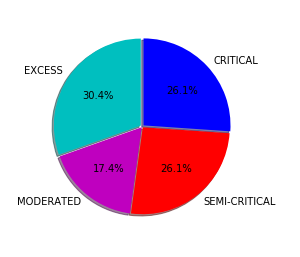

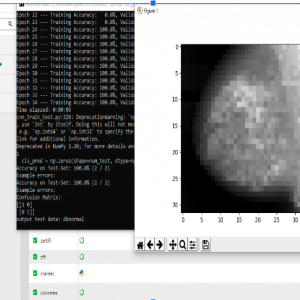

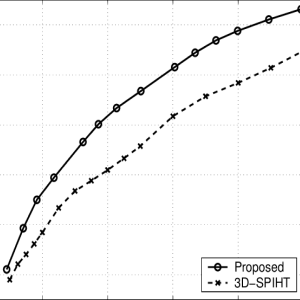

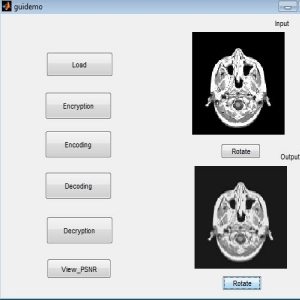

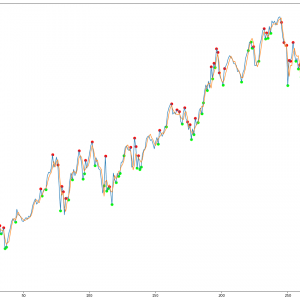

Here, we test the performance of three models in predicting daily cryptocurrency prices for 1,681 currencies. Two of the models are based on gradient boosting decision trees and one is based on long short-term memory (LSTM) recurrent neural networks. In all cases, we build investment portfolios based on the predictions and we compare their performance in terms of return on investment. We find that all of the three models perform better than a baseline a simple moving average? model? where a currency’s price is predicted as the average price across the preceding days, and that the method based on long short-term memory recurrent neural networks systematically yields the best return on investment.

Advantage:

- We present and compare the results obtained with the three forecasting algorithms and the baseline method.

- We predict the price of the currencies at day for all included between Jan, 1st 2016 and Apr 24th, 2018.

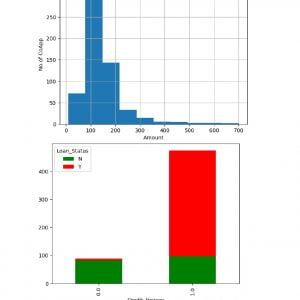

- The analysis considers all currencies whose age is larger than 50 days since their first appearance and whose volume is larger than $100000.

- To discount for the effect of the overall market movement (i.e., market growth, for most of the considered period), we consider cryptocurrencies prices expressed in Bitcoin.

Bitcoin

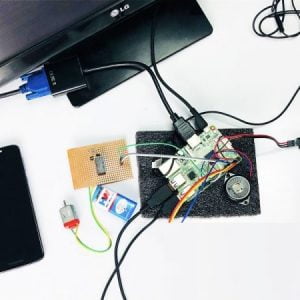

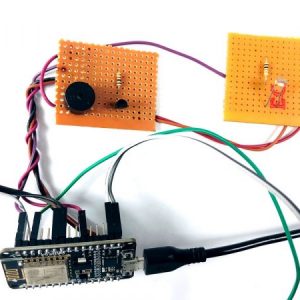

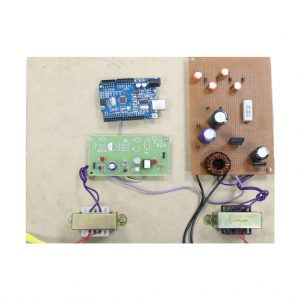

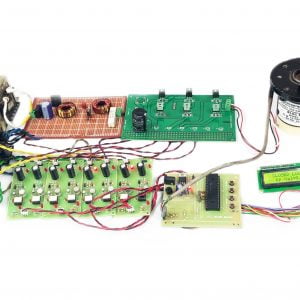

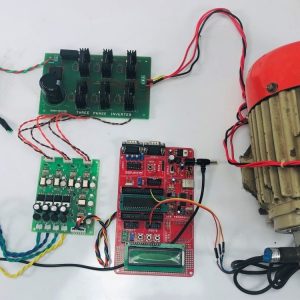

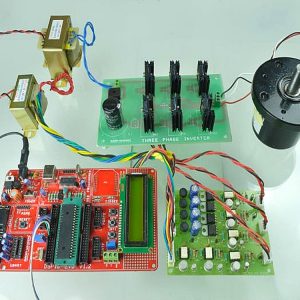

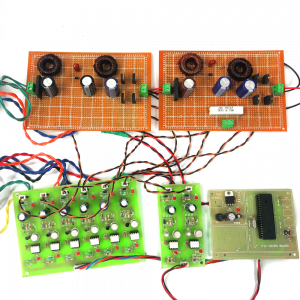

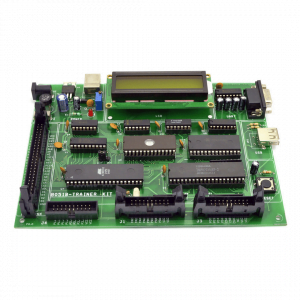

Hardware and Software Requirements:

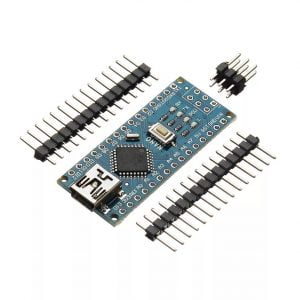

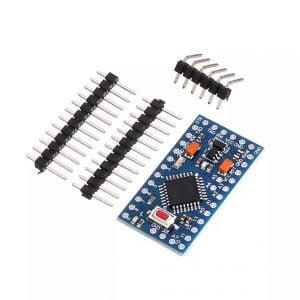

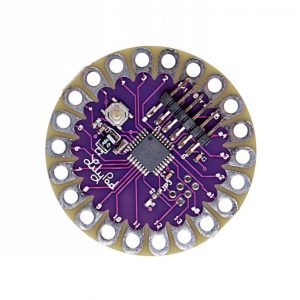

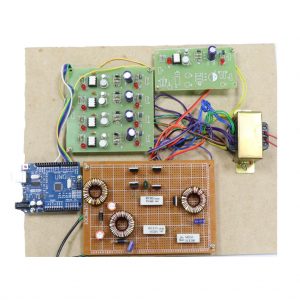

Hardware:

- OS??Windows 7,8 or 10 (32 or 64-bit)

- RAM? ?4GB

Software:

- Python IDLE

- Anaconda??Jupiter Notebook

Customer Reviews

There are no reviews yet.