Description

Stock Market Prediction using Machine Learning

Abstract:

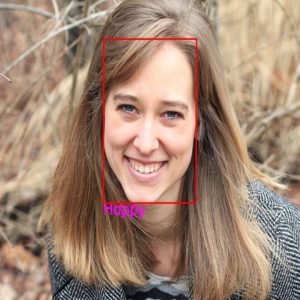

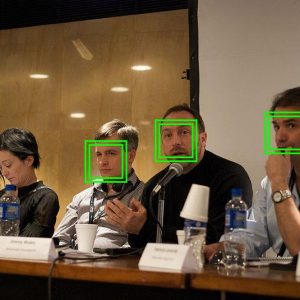

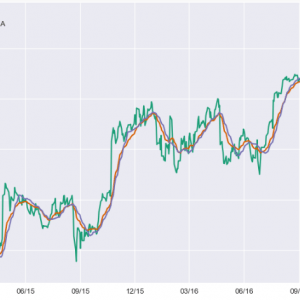

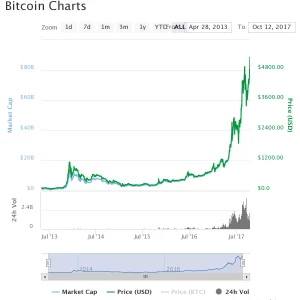

The goal of this paper is to review totally different techniques to predict stock worth movement victimization sentiment analysis from social media and data processing. During this paper, we are going to realize economic techniques which may predict stock movement additional accurately. Social media offers a robust outlet for people’s thoughts and feelings it’s a fast-ever-growing supply of texts starting from everyday observations to concerning discussions. Stock Market Prediction using Machine Learning This paper contributes to the sphere of sentiment analysis that aims to extract emotions and opinions from the text. A basic goal is to classify text as expressing either positive or negative feelings. Sentiment classifiers are designed for social media text like product reviews, blog posts, and even email corpus messages. With the increasing complexness of text sources and topics, it’s time to re-examine the quality sentiment extraction approaches, and probably to re-outline and enrich the definition of sentiment. Next, in contrast to sentiment analysis up to now, we have a tendency to examine sentiment expression and polarity classification inside and across varied social media streams by building topical datasets inside every stream. Totally different data processing ways area unit accustomed predict market additional with efficiency in conjunction with varied hybrid approaches. We have a tendency to conclude that stock prediction is an incredibly advanced task and varied factors ought to be thought of for prognostication of the market additional accurately and with efficiency. Stock Market Prediction using Machine Learning

Stock Market Prediction using Machine Learning

Introduction:

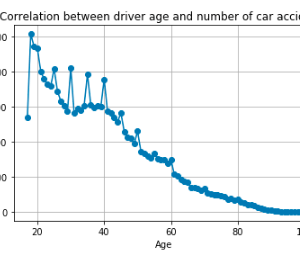

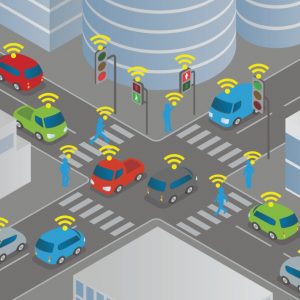

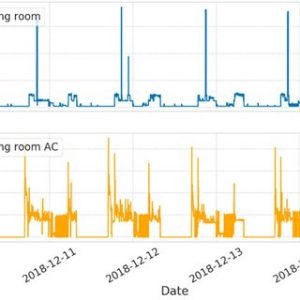

Stock market prediction is the act of trying to determine the future? value of a stock from social media offers a robust outlet for people’s thoughts and feelings Analysis of social media is strongly related to sentiment analysis Which is used to extract emotions and opinions from text Data mining methodologies like NLP, Random forest, Neural network is used for analyzing social network content and improves the average accuracy Recent analysis reveals the existence of attention-grabbing communication patterns? among completely different participants of various social network platforms. These patterns are shown to be helpful in predicting product sales and stock costs. Compared to a social network, which may be thought of as representing connections among folks within the public, a company network connects solely staff in a very huge corporation. While participants of a social network will specific opinions on any problems with interest, members of a company communication network area unit expected to chiefly say company-specific business. If human communication patterns will be discovered within the social networks to predict product sales or stock performance, one might surprise if such patterns additionally exist among members in company communication network to permit constant to be done. in contrast to social networks, in a very company communication network, e-mails have long been used as a tool for inter-organizational and inter-organizational data exchange. Within the same means, a social network platform is ready to capture participant’s behaviour and their opinions concerning varied problems and events. Thus, we tend to argue that a company communication network within the sort of Associate in nursing e-mail scheme additionally contains perceptive data, like structure stability and hardiness, a couple of company’s developments. We tend to believe our argument is in line with company communications, that suggests that ?employee communications will mean the success or failure of any major amendment program? ensuing from a merger, acquisition, new venture, new method improvement approach, or alternative management problems. In alternative words, worker communication will serve as a crucial? Does business operate that drives performance and contributes to a company’s financial success?. Based on these broad company communication theories, we tend to anticipate that each company has its own communication approach with identifiable patterns. we tend to believe that these communication patterns will reject however a company manages major company activities (such as mergers, acquisitions, new ventures, new method improvement approaches, going considerations, or bankruptcy) which will afterward influence the company’s performance within the exchange Stock Market Prediction using Machine Learning

Existing System:

In the existing system, we tend to propose that a company’s performance, in terms of its stock worth movement, is foreseen by internal communication patterns. to get early warning signals, we tend to believe that it’s vital for patterns in company communication networks to be detected earlier for the pre- diction of serious stock worth movement to avoid attainable adversities that an organization could face within the securities market in order that stakeholders? interests are protected by the maximum amount attainable. Despite the potential importance of such data regarding corporate communication, very little work has been tired this vital direction. We attempt to bridge these research gaps by employing a data-mining method to examine the linkage between a firm’s communication data and its share price. As Enron Corporation’s e-mail messages constitute the only corpus available to the public, we make use of Enron’s e-mail corpus as the training and testing data for our proposed algorithm.

Disadvantage:

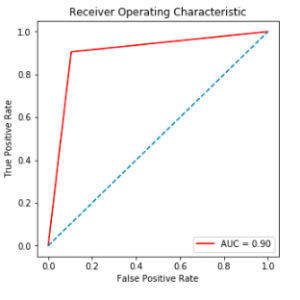

- However, accuracy would decrease when setting more levels of stock market movement.

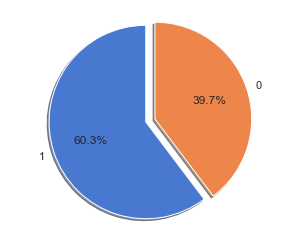

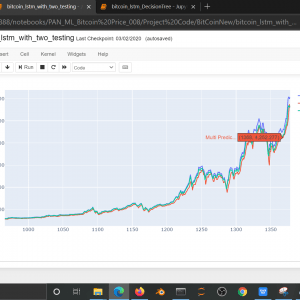

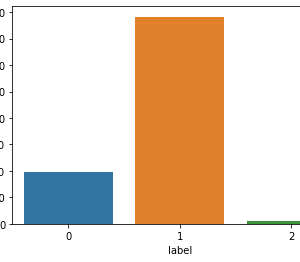

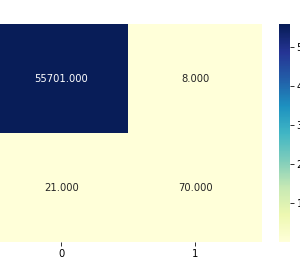

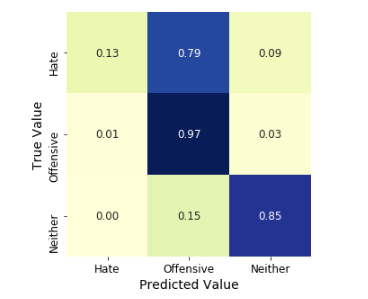

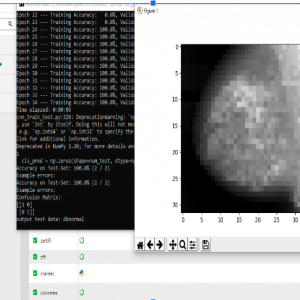

- The average prediction accuracies using Decision Tree as the classifier are 43.44%, 31.92%, and 12.06% for? two levels,? ?three levels,? and ? five levels,? respectively.

- These results indicate that the stock price is unpredictable when a traditional classifier is used.

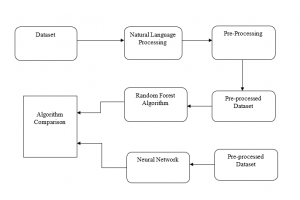

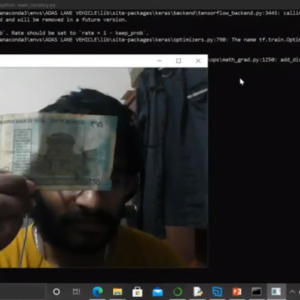

Proposed System:

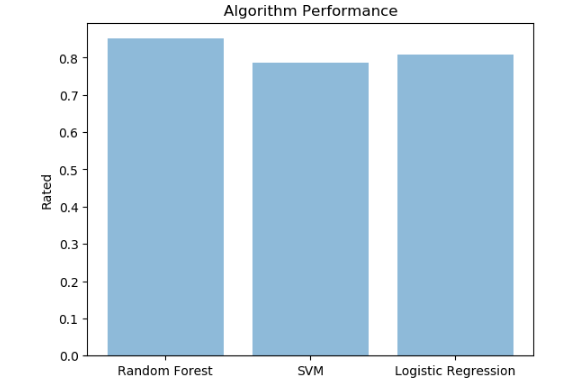

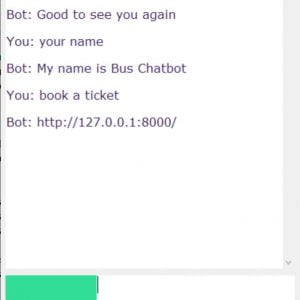

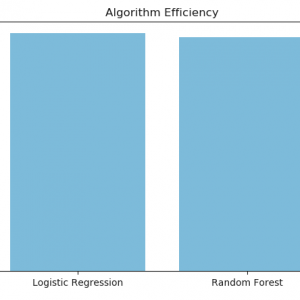

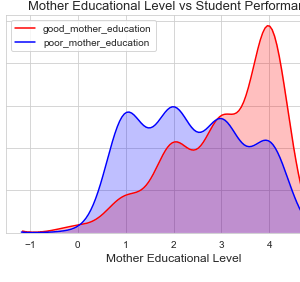

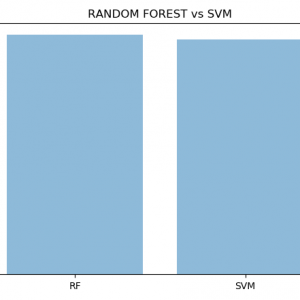

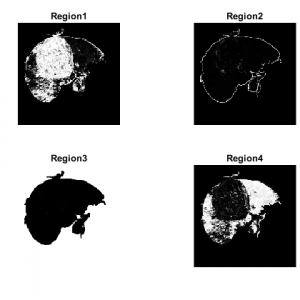

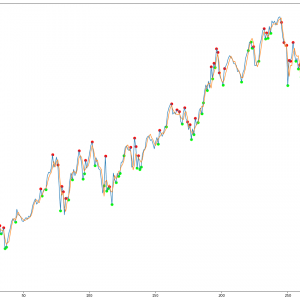

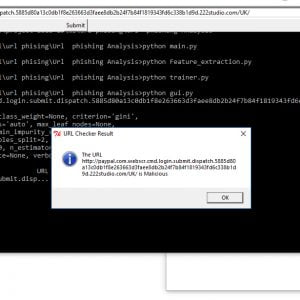

In this Proposed System, opinions can now be found almost everywhere – blogs, social networking sites like Facebook and Email, news portals, eCommerce sites, etc. While these opinions are meant to be helpful, the vast availability of such opinions becomes overwhelming to users when there is just too much to digest. Over the last few years, this special task of summarizing opinions has stirred tremendous interest amongst the Natural Language Processing (NLP) and Random Forest communities. ?Opinions? mainly include opinionated text data such as blog/review articles, and associated numerical data like aspect rating is also included. While different groups have different notions of what an opinion summary should be, we consider any study that attempts to generate a concise and digestible summary of a large number of opinions as the study of Opinion Summarization. For example, sentiment prediction on reviews of a product can give a very general notion of what the users feel about the product. If the user needs more specifics, then the topic-based summaries or textual summaries may be more useful. Regardless of the summary formats, the goal of opinion summarization is to help users digest the vast availability of opinions in an easy manner. The approaches utilized to address this summarization task vary greatly and touch on different areas of research including text clustering, sentiment prediction, Random Forest, NLP analysis, and so on. Some of these approaches rely on simple heuristics, while others use robust statistical models.

Advantage:

- We will classify the approaches in various ways and describe the techniques used in an intuitive manner.

- We will also provide various aspects of evaluation in opinion summarization, which was not covered by other previous surveys.

- Finally, we will provide insights into the weaknesses of the approaches and describe the challenges that remain to be solved in this area.

Stock market prediction using Classification Abstract

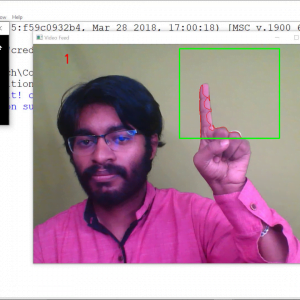

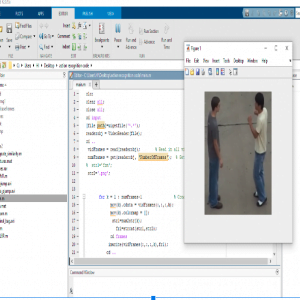

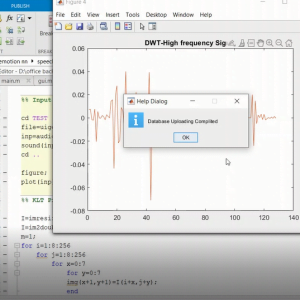

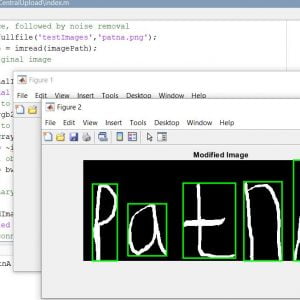

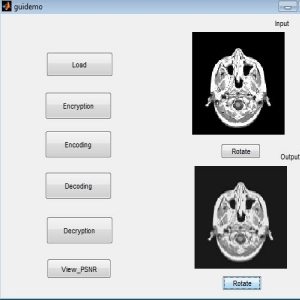

Software:

- Python 2.7

- Anaconda Navigator

Python’s

standard library

- Pandas

- Numpy

- Sklearn

- tkMessageBox

- matplotlib

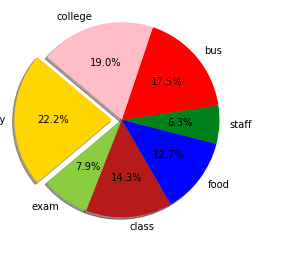

Customer Reviews

There are no reviews yet.